Understanding the Dynamics of Impact Investing

Investing has always been about creating profits, but a new trend is making it about much more. Impact investing aims to create positive social and environmental change, alongside financial gains. This innovative approach is redefining the investment landscape, providing investors with the unique opportunity to make a difference while making money.

A Closer Look at Impact Investing

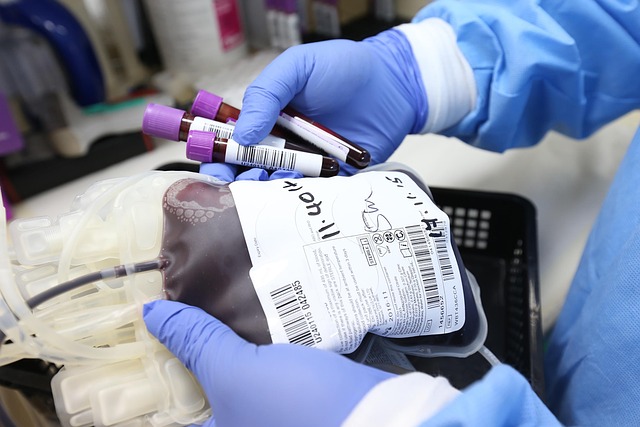

Impact investing, as the name suggests, involves investing in projects, companies, or funds with the intention of generating a measurable, positive social or environmental impact, as well as a financial return. This approach has gained momentum in the last decade, as investors seek to align their financial strategies with their values. Impact investing covers a wide range of sectors, including renewable energy, sustainable agriculture, affordable housing, and healthcare.

Market Trends and Insights

A report by the Global Impact Investing Network (GIIN) highlights that the impact investing market is estimated at $715 billion, as of 2020. This exponential growth is driven by increased investor interest and the growing recognition of the role that the private sector can play in addressing global challenges. Furthermore, a study by the Forum for Sustainable and Responsible Investment indicates that the majority of investors are satisfied with the performance of their impact investments, both in terms of their impact and financial return.

The Impact: Benefits and Risks

The primary benefit of impact investing is the ability to generate positive change. By investing in projects or companies that contribute to societal or environmental well-being, investors can play a part in addressing global issues. Additionally, impact investments can offer competitive returns, diversification, and the potential for long-term growth.

However, like any investment, impact investments come with risks. These include market risk, liquidity risk, and impact risk—the risk that the investment does not achieve its intended impact. It’s crucial for investors to thoroughly evaluate these risks before venturing into impact investing.

Real-world Applications

One notable example of impact investing is the investment in affordable housing projects. By investing in these projects, investors contribute to reducing homelessness and improving living conditions, while also earning a return. Similarly, investments in renewable energy projects contribute to the fight against climate change and offer substantial growth potential.

Practical Insights

-

Understand the Impact: Before investing, understand the social or environmental impact of the project or company. Research their mission, operations, and impact metrics.

-

Evaluate the Risks: Understand the financial risks involved and ensure they align with your risk tolerance.

-

Diversify: Consider diversifying your impact investments across different sectors and geographies to spread risk.

-

Seek Professional Advice: If you’re new to impact investing, consider seeking advice from a financial advisor experienced in this area.

Conclusion

Impact investing offers a unique opportunity for investors to align their financial strategies with their values, driving positive change while also generating returns. By understanding the dynamics of impact investing, investors can make informed decisions that contribute to a sustainable future. As this trend continues to gain momentum, it’s clear that impact investing is not just a passing fad—it’s a powerful movement that’s redefining the way we invest.